Top 30 Forex Brokers Fundamentals Explained

Top 30 Forex Brokers Fundamentals Explained

Blog Article

The Single Strategy To Use For Top 30 Forex Brokers

Table of ContentsThe smart Trick of Top 30 Forex Brokers That Nobody is Discussing6 Easy Facts About Top 30 Forex Brokers ShownThe smart Trick of Top 30 Forex Brokers That Nobody is Talking AboutAbout Top 30 Forex Brokers10 Simple Techniques For Top 30 Forex BrokersThe Facts About Top 30 Forex Brokers UncoveredSome Known Details About Top 30 Forex Brokers Top 30 Forex Brokers for Dummies

Like other circumstances in which they are made use of, bar charts give more cost information than line charts. Each bar chart stands for someday of trading and consists of the opening rate, greatest price, cheapest cost, and shutting price (OHLC) for a trade. A dashboard on the left represents the day's opening price, and a similar one on the right stands for the closing price.Bar charts for currency trading aid investors determine whether it is a buyer's or seller's market. Japanese rice traders first utilized candle holder graphes in the 18th century. They are aesthetically much more attractive and simpler to check out than the graph kinds explained over. The top portion of a candle light is made use of for the opening cost and highest cost point of a money, while the reduced part suggests the closing cost and least expensive rate factor.

Getting The Top 30 Forex Brokers To Work

The formations and shapes in candlestick graphes are utilized to recognize market direction and motion. Several of the extra typical formations for candle holder charts are hanging male - https://filesharingtalk.com/members/591060-top30forexbs and shooting celebrity. Pros Largest in regards to day-to-day trading quantity in the globe Traded 24 hr a day, five and a half days a week Beginning resources can quickly increase Generally adheres to the very same rules as normal trading More decentralized than standard stock or bond markets Cons Utilize can make forex professions really volatile Utilize in the variety of 50:1 prevails Calls for an understanding of economic basics and indicators Much less regulation than other markets No income producing instruments Foreign exchange markets are the largest in regards to daily trading volume worldwide and consequently offer one of the most liquidity.

Banks, brokers, and dealers in the forex markets enable a high amount of take advantage of, implying traders can regulate large placements with relatively little cash. Take advantage of in the variety of 50:1 is typical in foreign exchange, though even greater quantities of take advantage of are readily available from certain brokers. Leverage must be utilized cautiously due to the fact that numerous unskilled investors have actually experienced significant losses utilizing more utilize than was needed or sensible.

More About Top 30 Forex Brokers

A currency trader needs to have a big-picture understanding of the economic situations of the different nations and their interconnectedness to comprehend the basics that drive currency worths. The decentralized nature of forex markets suggests it is less regulated than other financial markets. The degree and nature of regulation in foreign exchange markets rely on the trading territory.

The volatility of a particular money is a feature of several aspects, such as the politics and economics of its country. Occasions like economic instability in the type of a payment default or inequality in trading connections with another money can result in considerable volatility.

The Single Strategy To Use For Top 30 Forex Brokers

The Financial Conduct Authority (https://triberr.com/top30forexbs) (FCA) displays and controls forex sell the UK. Money with high liquidity have a prepared market and show smooth and predictable rate activity in reaction to outside occasions. The U.S. dollar is one of the most traded money on the planet. It is paired in 6 of the market's seven most fluid money pairs.

The Basic Principles Of Top 30 Forex Brokers

In today's info superhighway the Forex market is no longer entirely for the institutional financier. The last 10 years have actually seen a rise in non-institutional traders accessing the Foreign exchange market and the advantages it supplies.

A Biased View of Top 30 Forex Brokers

Foreign exchange trading (forex trading) is a global market for getting and offering money - FBS. 6 trillion, it is 25 times bigger than all the world's stock markets. As an outcome, rates transform constantly for the currencies that Americans are most likely to make use of.

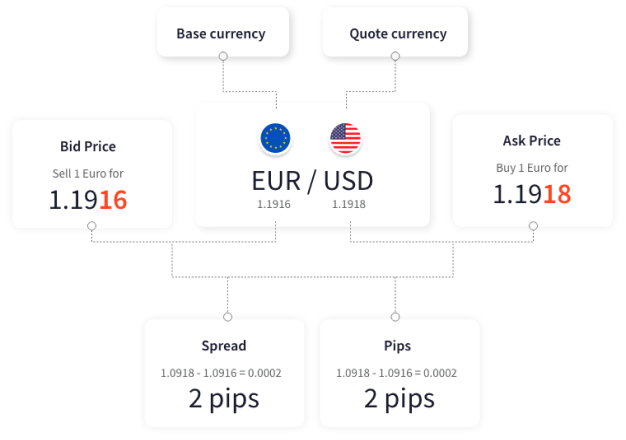

All money trades are carried out in pairs. When you sell your money, you get the payment in a various currency. Every vacationer who has gotten foreign money has done foreign exchange trading. For instance, when you go on holiday to Europe, you trade bucks for euros at the going rate. You market united state

An Unbiased View of Top 30 Forex Brokers

Place purchases resemble trading currency for a journey abroad. Spots are agreements in between the investor and the market manufacturer, or dealership. The investor buys a specific money at the buy rate from the marketplace maker and offers a different currency at the market price. The buy rate is rather higher than the asking price.

This is the purchase expense to the trader, which subsequently is the revenue gained by the market manufacturer. You paid this spread without recognizing it when you exchanged your bucks for international money. You would certainly discover it if you made the transaction, canceled your trip, and after that tried to exchange the money back to dollars as soon as possible.

The 20-Second Trick For Top 30 Forex Brokers

You do this when you assume the currency's worth will certainly drop in the read this post here future. Services short a currency to protect themselves from risk. Shorting is really risky. If the money rises in worth, you need to buy it from the supplier at that price. It has the exact same pros and disadvantages as short-selling stocks.

Report this page